Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

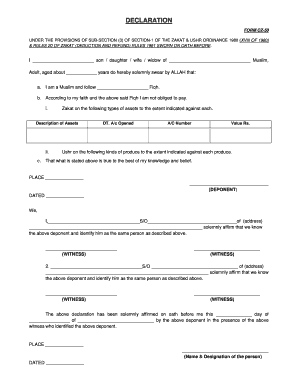

Bupa Tax Exemption Form / Bupa Ipt Exemption Declaration - Fill Online, Printable ... : Must these transactions be exempt?

Bupa Tax Exemption Form / Bupa Ipt Exemption Declaration - Fill Online, Printable ... : Must these transactions be exempt?. Driving, traveling, home offices and student. This video will give you step by step instructions on how i became tax exempt on my purchases for my ebay dropshipping business. As per the convention, the system is hugely complex and rigid. Complete this form to claim an exemption from tax when a vehicle, vessel, camper, trailer, or recreational vehicle is being transferred/received as a gift. Your business is partly exempt if your business has incurred vat on purchases that relate to exempt supplies.

They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Commonwealth of virginia sales and use tax certificate of exemption. Use this form to apply for the exemption for qualifying disabled veterans from local car or truck tax. If you and your employer qualify for these exemptions, you. You may claim a tax exemption for tax year 2017 for each dependent if all of the following statements are true dependent tax exemptions can only be claimed on form 1040a or 1040.

You may claim a tax exemption for tax year 2017 for each dependent if all of the following statements are true dependent tax exemptions can only be claimed on form 1040a or 1040.

The samples provided in the links assures one thing, you get the best idea in the market about the associated fields you have to deal with while applying for tax exemption schemes. Companies obtaining personal services from purdue request this form to verify purdue's tax identification number and exemption from tax withholding. This is known as exempt input tax. Must these transactions be exempt? Exemption numbers or exemption form* (if applicable). Please refer to our disabled veterans exemption page for additional information, instructions for applying, and documentation that must be submitted along with this application. As per the convention, the system is hugely complex and rigid. These items are exempt from vat so are not taxable. The forms listed below are pdf files. For exemptions relating to tax warehouses, see exemptions for tax warehouses. Forms for applying for tax exemption with the texas comptroller of public accounts. With the growth of our country's economy, the amount of tax that we need to bear has gone up, and with each passing budget. Complete this form to claim an exemption from tax when a vehicle, vessel, camper, trailer, or recreational vehicle is being transferred/received as a gift.

A separate exemption certificate is required from each person claiming exemption. If the institution files irs form 990, return of organization exempt from income tax, provide a copy of the most recently completed form with the application. Please refer to our disabled veterans exemption page for additional information, instructions for applying, and documentation that must be submitted along with this application. Appeared first on smartasset blog. You may claim a tax exemption for tax year 2017 for each dependent if all of the following statements are true dependent tax exemptions can only be claimed on form 1040a or 1040.

Your business is partly exempt if your business has incurred vat on purchases that relate to exempt supplies.

Exemption certificates are a way for a business or organization to attest that you are a tax exempt entity, or that you are purchasing an item with the intent to use it in a way that has been deemed exempt from tax. Please refer to our disabled veterans exemption page for additional information, instructions for applying, and documentation that must be submitted along with this application. Usage of sample tax exemption forms. Must these transactions be exempt? If the institution files irs form 990, return of organization exempt from income tax, provide a copy of the most recently completed form with the application. Exemption numbers or exemption form* (if applicable). Visit gsa smartpay to find state tax exemption forms and/or links directly to state websites. Bupa insurance premium tax exemption form. Employees providing domestic services, such as respite or nursing, may be exempt from paying certain federal and state taxes based in some cases, the employer may also be exempt based on the employee's status. Use this form to apply for the exemption for qualifying disabled veterans from local car or truck tax. We do not accept sales tax permits, articles of incorporation, tax licenses, irs determination letter (unless required by state law), w9's, or certificate of registrations for enrollment into the program. How to prepare a 501c3 non profit tax exempt application, the irs tax exempt form application for recognition of exemption. The forms listed below are pdf files.

In the 2017 tax year, the exemption typically resulted in a $4,050 reduction of taxable income for each one you qualified for. For exemptions relating to tax warehouses, see exemptions for tax warehouses. Tax exemption helps in curtailing the burden of taxable income during a financial year. Bupa insurance premium tax exemption form. Tax exemption refers to a monetary exemption which decreases the taxable income.

Bupa insurance premium tax exemption form.

Complete this form to claim an exemption from tax when a vehicle, vessel, camper, trailer, or recreational vehicle is being transferred/received as a gift. Exemption certificates are a way for a business or organization to attest that you are a tax exempt entity, or that you are purchasing an item with the intent to use it in a way that has been deemed exempt from tax. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Visit gsa smartpay to find state tax exemption forms and/or links directly to state websites. With the growth of our country's economy, the amount of tax that we need to bear has gone up, and with each passing budget. The samples provided in the links assures one thing, you get the best idea in the market about the associated fields you have to deal with while applying for tax exemption schemes. Guide to irs non profit tax exempt 501c3 status. An aspect of fiscal policy. A separate exemption certificate is required from each person claiming exemption. A taxpayer may buy an asset and subsequently sell that asset for a. For a family that qualified for four exemptions, the total reduction a simple tax return is form 1040 only (without any additional schedules) or form 1040 + unemployment income. To be retained by vendor as evidence of exempt sale. The forms listed below are pdf files.

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

File Label Template - Lever Arch File Spine Labels Filing Labels Octopus ... : Select more templates if you don't see you can also go to templates.office.com, and search for label.

- Dapatkan link

- X

- Aplikasi Lainnya

Agretto Agricultural Machinery Mail / Textile Machinery Mail : Errebi S R L Privacy - Santeks ... / / the foundation of agretto's c.

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar